Your Modern CPA Partner

Year-round tax strategy and bookkeeping for Texas business owners and stock option holders

Your Modern CPA Partner

Year-round tax strategy and bookkeeping for Texas business owners and stock option holders

Your Modern CPA Partner

Year-round tax strategy and bookkeeping for Texas business owners and stock option holders

Three Ways We Work Together

Three Ways We Work Together

Three Ways We Work Together

Three Ways We Work Together

Choose the level of support that fits your needs. From basic tax prep to full accounting service.

Choose the level of support that fits your needs. From basic tax prep to full accounting service.

Compliance

Compliance

Annual tax preparation with year-round access

Annual tax preparation with year-round access

Collaboration

Collaboration

Year-round collaboration with proactive planning

Year-round collaboration with proactive planning

concierge

concierge

White glove service with a hands-off approach

White glove service with a hands-off approach

Why Choose Graf Tax

We're changing how CPA firms operate. Modern technology meets clear communication and year-round support.

Save on taxes with strategic planning

Year-Round Support when you need it

Video Explanations to understand every decision on your return

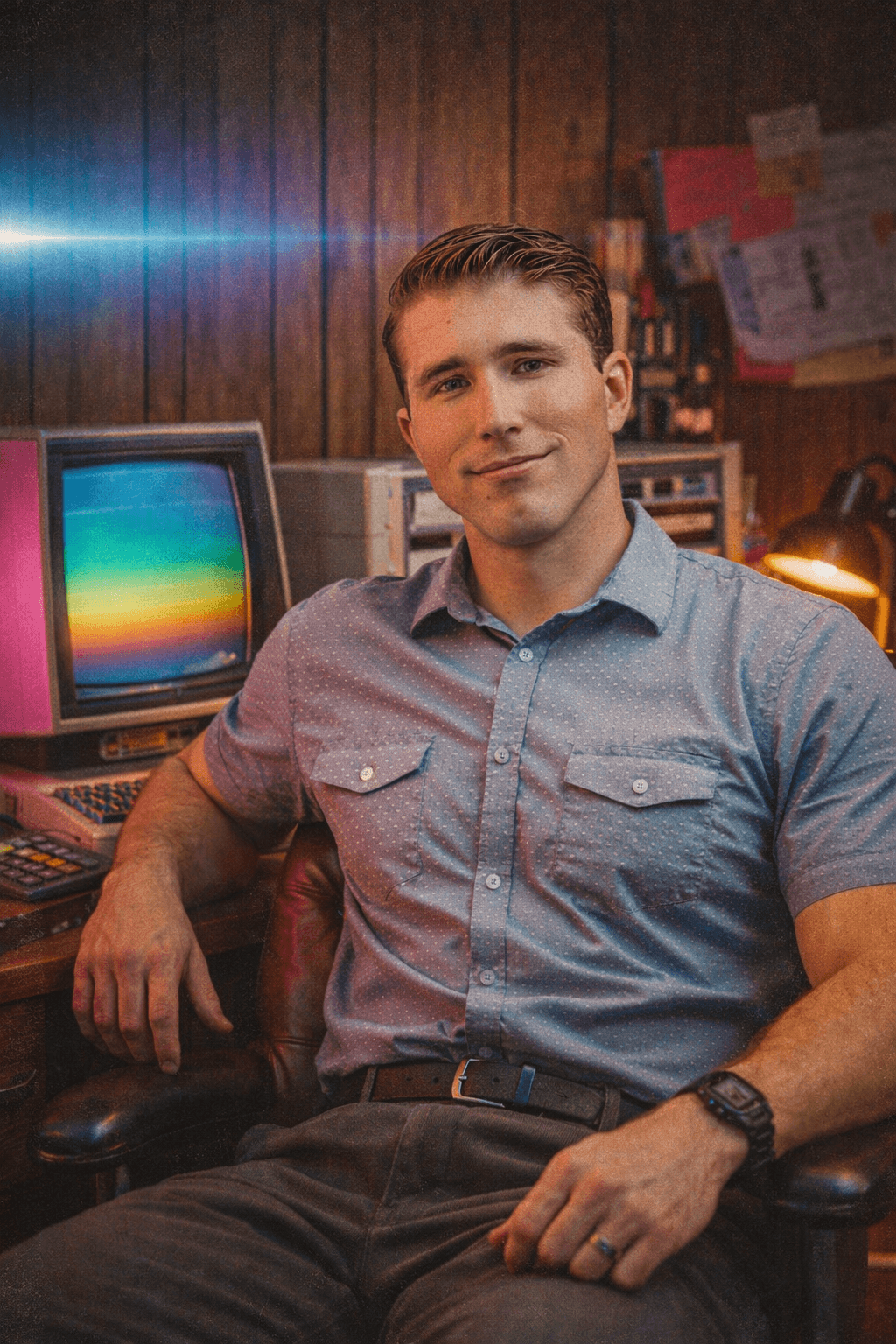

Hi, I'm Logan

Hi, I'm Logan

Hi, I'm Logan

Taxes and bookkeeping don't have to be complicated. I help business owners understand their numbers without the confusing accounting speak.

Whether you're navigating stock options or planning a major business purchase, I break it down so you can make informed decisions.

I've built my practice around using modern technology and staying accessible year-round. When you work with me, you're not just getting a CPA who shows up once a year.

I also create content for YouTube and lead a community for accounting firm owners, which keeps me on the cutting edge of what actually works in this industry.

How We Work Together

STEP 1

STEP 1

Discovery Call

Discovery Call

Discovery Call

We'll discuss your situation and find the right service level for you.

STEP 2

STEP 2

Get Connected

Get Connected

Get Connected

Simple setup with technology that actually makes your life easier.

STEP 3

STEP 3

Ongoing Partnership

Ongoing Partnership

Ongoing Partnership

Year-round support with regular check-ins and clear explanations.

Pick The Service Level That Works For You

Pick The Service Level That Works For You

Service levels for businesses and individuals. Extra services for businesses: Monthly bookkeeping & payroll assistance.

Service levels for businesses and individuals. Extra services for businesses: Monthly bookkeeping & payroll assistance.

Our average fee for individual tax returns is $2,000 and $2,500 for S-Corps/Partnerships

Compliance +

Annual tax preparation and filing for business owners who need it done right.

Tax return preparation

Video walkthrough

Year-round support

IRS notice assistance

Newsletter subscription

Compliance +

Annual tax preparation and filing for business owners who need it done right.

Tax return preparation

Video walkthrough

Year-round support

IRS notice assistance

Newsletter subscription

Compliance +

Annual tax preparation and filing for business owners who need it done right.

Tax return preparation

Video walkthrough

Year-round support

IRS notice assistance

Newsletter subscription

Collaboration

Year-round CPA relationship with proactive planning and ongoing support.

Everything in Compliance +

Tax & strategy planning meeting

Priority response

Collaboration

Year-round CPA relationship with proactive planning and ongoing support.

Everything in Compliance +

Tax & strategy planning meeting

Priority response

Collaboration

Year-round CPA relationship with proactive planning and ongoing support.

Everything in Compliance +

Tax projections and planning

Priority response

Concierge

Complete accounting solution for business owners who want hands-off financial management.

Everything in Collaboration

Quarterly estimates

Mutliple planning meetings

Concierge

Complete accounting solution for business owners who want hands-off financial management.

Everything in Collaboration

Quarterly estimates

Mutliple planning meetings

Concierge

Complete accounting solution for business owners who want hands-off financial management.

Everything in Collaboration

Quarterly estimates

Mutliple planning meetings

Frequently Asked Questions

Frequently Asked Questions

Frequently Asked Questions

Get straight answers about working together.

Get straight answers about working together.

How are you different from other CPAs & Tax Preparers?

I focus on education and clear communication. Every tax return comes with a video explanation, and I'm available year-round, not just during tax season.

What's included in the video walkthrough?

I walk through your entire tax return, explain the decisions I made, highlight any planning opportunities, and answer questions about your specific situation.

Do you work with clients outside of Texas?

No, I only work with clients in Texas. This allows me to stay up-to-date on state-specific tax laws and provide the best service possible.

How do you handle stock options and complex situations?

I specialize in helping people navigate RSUs, ESPPs, ISOs, and other stock compensation. I'll help you understand the tax implications before you make decisions.

What happens during our initial consultation?

We'll discuss your situation, tax concerns, and goals. I'll answer any quick tax questions you have and explain how I work. Then we'll determine if my services are a good fit for your needs.

Do you only work with businesses and stock option situations?

No, we also work with those who have rental properties.

What types of businesses do you work with?

I specialize in service-based businesses and companies in the film and video production industry. These are areas where I have deep experience navigating the unique tax situations that come up.

How are you different from other CPAs & Tax Preparers?

I focus on education and clear communication. Every tax return comes with a video explanation, and I'm available year-round, not just during tax season.

What's included in the video walkthrough?

I walk through your entire tax return, explain the decisions I made, highlight any planning opportunities, and answer questions about your specific situation.

Do you work with clients outside of Texas?

No, I only work with clients in Texas. This allows me to stay up-to-date on state-specific tax laws and provide the best service possible.

How do you handle stock options and complex situations?

I specialize in helping people navigate RSUs, ESPPs, ISOs, and other stock compensation. I'll help you understand the tax implications before you make decisions.

What happens during our initial consultation?

We'll discuss your situation, tax concerns, and goals. I'll answer any quick tax questions you have and explain how I work. Then we'll determine if my services are a good fit for your needs.

Do you only work with businesses and stock option situations?

No, we also work with those who have rental properties.

What types of businesses do you work with?

I specialize in service-based businesses and companies in the film and video production industry. These are areas where I have deep experience navigating the unique tax situations that come up.

How are you different from other CPAs & Tax Preparers?

I focus on education and clear communication. Every tax return comes with a video explanation, and I'm available year-round, not just during tax season.

What's included in the video walkthrough?

I walk through your entire tax return, explain the decisions I made, highlight any planning opportunities, and answer questions about your specific situation.

Do you work with clients outside of Texas?

No, I only work with clients in Texas. This allows me to stay up-to-date on state-specific tax laws and provide the best service possible.

How do you handle stock options and complex situations?

I specialize in helping people navigate RSUs, ESPPs, ISOs, and other stock compensation. I'll help you understand the tax implications before you make decisions.

What happens during our initial consultation?

We'll discuss your situation, tax concerns, and goals. I'll answer any quick tax questions you have and explain how I work. Then we'll determine if my services are a good fit for your needs.

Do you only work with businesses and stock option situations?

No, we also work with those who have rental properties.

What types of businesses do you work with?

I specialize in service-based businesses and companies in the film and video production industry. These are areas where I have deep experience navigating the unique tax situations that come up.

Let's See If We're a Good Fit

Let's See If We're a Good Fit

Stop guessing about your tax situation and making financial decisions in the dark. Work with a CPA who breaks things down clearly and stays with you all year.

Stop guessing about your tax situation and making financial decisions in the dark. Work with a CPA who breaks things down clearly and stays with you all year.